Levin & Perconti Reflect on the Tragic School Bus Collision in Western Illinois

RUSHVILLE, IL – The community of Rushville, Illinois, is devastated after a collision involving a school bus and a semi-truck killed five people, including three

RUSHVILLE, IL – The community of Rushville, Illinois, is devastated after a collision involving a school bus and a semi-truck killed five people, including three

The incident at the Judge Fisher Apartments remind us all of the vulnerabilities our cherished seniors face, even in places meant to ensure their safety.

Recreational activities are a great way to unwind and enjoy life. But what happens when these fun-filled moments turn tragic due to unforeseen accidents? At

On June 17, 2023, a horrific shooting incident occurred during an illegally organized Juneteenth celebration in Willowbrook, Illinois, which resulted in one fatality and left

Questions have surfaced regarding the mysterious police custody death of Glenn Foster Jr., a Chicago native who played for the New Orleans Saints from 2013

The Astroworld Festival in Houston was a much-anticipated event this year, with music fans flocking to the large concert. Unfortunately, this year’s concert ended in

Texas Gas Leak Explosion Leaves Multiple Wounded A suspected gas leak is thought to be the cause of an explosion that destroyed multiple houses and

Congratulations to these Levin & Perconti attorneys recognized in Leading Lawyers magazine as Top Attorneys. Their peers have recommended these exceptional attorneys in their practice areas among

Three People Connected to the Greater Chicago-Area Still Unaccounted For After Florida Condo Collapse On Friday, June 25, 2021, The Chicago Tribune reported that more than 150

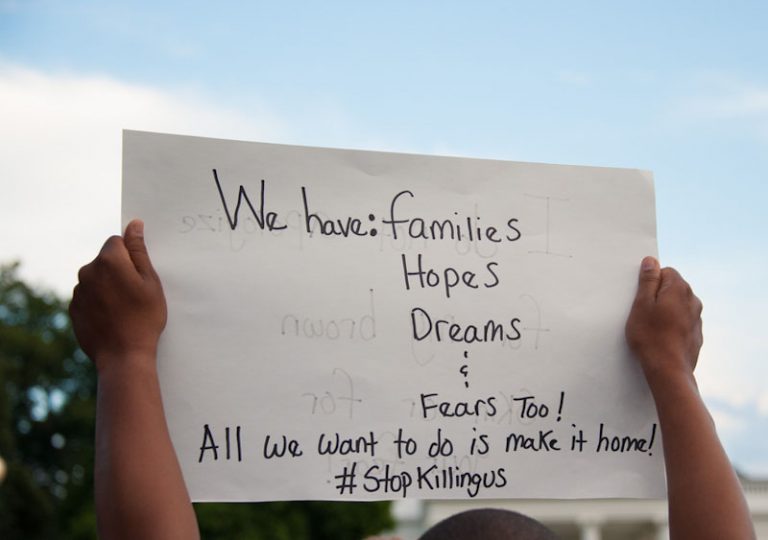

What Do You Know About the Migrant Shelters Around Chicago? Thousands of children remain detained by Customs and Border Protection and ICE, and horrific stories

Family Files Wrongful Death Suit After Police Shooting of Ricardo Muñoz Attorneys Steven Levin, Daisy Ayllon, and Julie Murphy from Levin & Perconti in Chicago

Proposed SAFE TECH ACT Could Help Safeguard Against Fraud, Abuse, and Exploitation of Online Users With so many more individuals, organizations, and private companies using

Levin & Perconti Represents Family Who Lost Mentally Ill Son in Deadly Encounters with Pennsylvania Law Enforcement Levin & Perconti attorneys Steven Levin and Daisy Ayllon are

Athletes expect that their athletic trainers will be able to assess their injuries and look out for their best interests. In fact, under Illinois law,

Our Chicago personal injury attorneys, Steven Levin and Michael Bonamarte, recently helped the family of a victim of a wrongful death reach a $975,000 settlement

Nursing home regulations aim to guarantee that residential facilities provide safe, sanitary, home-like environments where residents receive quality care. Inadequate regulation in nursing homes has

The Apgar score is a rapid assessment of your baby’s health following birth to determine if intervention is needed. Although not used to diagnose birth

Bringing a child into the world should be a joyous occasion, yet for many expectant mothers, especially women of color, the experience is marred by

Copyright © 2023, Levin & Perconti